Alex, Edgewater Markets has been growing considerably Y/Y for many years, what do you attribute that steady trajectory to?

From the onset, we strive to address the market’s needs and, more specifically, client needs. From years of collective experience working for wall street firms, we have identified many gaps in product offerings that need to be solved for. Moreover, each region around the globe, each product, and every distinct client segment (bank, broker dealer, asset manager, family office, etc..) has its own very specific set of requirements. Addressing pricing disparities across the range of LPs, selective market access, restrictive credit counterparties, and generally poor legacy technology options was imperative.

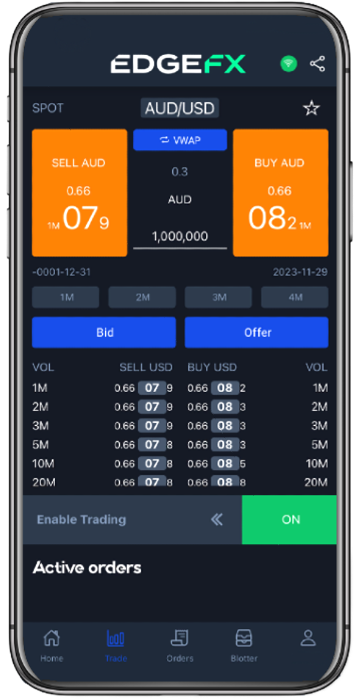

We recognized since inception that the only path forward was to develop a modern, robust, scalable, and relevant technology stack to address and solve these issues. Today we have a best of breed tech platform that is highly customizable and can address the needs of tier 1 global macro funds focused on G10 currencies to regional LATAM financial institutions, with very limited credit access, focused on onshore/offshore NDF hedging, for example. Our growth has also benefited from focusing on emerging markets where our product offering can be hugely impactful from the onset. We offer a comprehensive, front-to-back trading platform engineered for price generation, liquidity aggregation, execution management, and real-time risk and credit validation—supported by high-quality execution services and advanced credit intermediation capabilities. Our clients want to partner with a firm that can accelerate their electronification process, while providing greater access to global markets efficiently and at the right price point.

Being a global business, open 24 hours a day 6 days a week, how has the growth created challenges and opportunities across the globe?

Growing at the pace we have over the past few years doesn’t come without its fair share of challenges. In just the past year we have significantly increased our product offerings, entered new markets (Korea, Argentina, India H1’26) and developed a new UK regulated platform for an entirely new client segment. First and foremost, hiring the right people is paramount. In each of these areas of growth we have hired and partnered with highly qualified professionals who understand local onshore client needs and have a deep understanding of technology requirements as they relate to their region and products.

As importantly, our tech stack is very scalable and provides us opportunities to continue to grow with our clients in different product areas. For example, in Mexico, where we are the leading platform, we are developing a fixed income electronic platform at the behest of the local regulator and of our long-standing client base.

We would not be in this position without the strength of our technology platform and our continued investment in development. Our commitment to SG1, our long-standing presence in NY4 and LD4, and our growing use of high-speed AI infrastructure have enabled us to extend our reach to the farthest corners of the financial world.

Matt Maloney, CEO of Edgewater Markets UK

Following the momentum built in 2025, what is Edgewater aiming to achieve in 2026 to elevate the FCA-regulated business and broaden its institutional footprint?

By joining in the middle of the hottest market for bullion—and with Edgewater focused on gold and silver in its FCA business—the early conversations made it clear that the opportunity was far bigger than a single-asset play. Edgewater’s strength in precious metals gives us an ideal launchpad, but 2026 is about broadening that into a truly multi-product, institutional offering.

After a highly successful 2025, the focus for 2026 is scaling the FCA-regulated business into a deeper and more diversified liquidity and technology solution. The strategy builds on what we already do exceptionally well while expanding into Deliverable FX, Emerging market NDFs and other Products.

To support this, we’ve been laying foundational work across technology, operations, and client coverage, ensuring robust execution, pricing, and governance as we scale. We are also strengthening the team, deepening our regional and international presence, and aligning our capabilities with institutional demand. I’m confident that what we are building will become a leading institutional hub in London and a cornerstone franchise for Edgewater Markets globally.

Robert Sanchez, Managing Director, Head of LatAM

Edgewater has seen significant traction throughout Latin America. What have been the critical factors behind this success, and do you believe there is a distinctive competitive advantage at play?

First, understanding client’s business and needs is key, it sounds superficial as an answer, but large tech players have difficulties adapting the technology to clients in LATAM. We build relationships and partner with our clients to work together to implement a cutting -edge technology that works for them. Building trust takes time and consistency. Clients have learned to trust us and our tech reputation has therefore grown in the region. Second, having our own tech in house and a strong team of developers have proven to be extremely relevant. We build bespoke tech for clients and by clients. Third, we have a LATAM dedicated Ops teams that monitors and assist our regional client during market hours. Understanding client needs is key to success, at Edgewater we focus on franchise specific tailored technology with proven results.

Industry observers note that Edgewater has entered Argentina ahead of the broader market, positioning itself before competitors in a landscape that has not fully opened yet. Do you view Argentina as the next major opportunity in Latin America?

Edgewater is intensifying its focus on Argentina as President Milei and his economic, financial, and central bank teams work to address the country’s macroeconomic challenges. We believe the next step is to help Argentinian players to come back to international FX markets and understand that supporting this change now is even more relevant than when the market is fully opened. Local financial institutions have received us very well, most with considerable optimism. Local futures market trades an average of $1 billion per day, however, the offshore ARS NDF market is less than $30 million per day. We are going to change that, connecting local liquidity with foreign investors. We understand that the plan proposed by President Milei and his team is moving in the right direction, but it will take some time. We are developing the necessary tech to give local financial institutions access to NDF markets to manage their derivatives positions. This would not affect the level of reserves and would allow the local FX market to develop hedging tools for companies to daily manage risk, and of course, for sophisticated investors eager to finance local companies in local currency. Our contribution is key to the development of the Argentinian FX market.

Nate Arenchild, COO of Edgewater Markets LLC

Why did Edgewater relocate its U.S. headquarters to Miami, and how does this support the company’s growth strategy?

Relocating our U.S. headquarters to Miami positions Edgewater precisely where FX, financial markets, and emerging market growth intersect. Miami has become one of the fastest rising fintech and institutional finance hubs, attracting major firms like Citadel, Blackstone, Goldman Sachs, and JPMorgan while hosting over 60 international banks and hundreds of wealth managers. This ecosystem aligns directly with our strategic investments across Latin America, where we maintain staffed offices in Mexico, Chile, Brazil, Peru, and Argentina. Miami enables deeper integration with those markets, improving our ability to serve regional institutions with white-label technology solutions. The relocation has also strengthened our ability to recruit top talent across product, engineering, markets, and operations while retaining key senior contributors excited by the opportunity to scale globally from Miami. Parallel expansions in London and Singapore enhance regulatory coverage and development velocity, collectively forming a globally synchronized platform. Miami isn’t just our headquarters—it is the strategic bridge tying emerging market demand to our broader global execution capabilities.

How does being headquartered in Miami enhance Edgewater’s competitive edge in delivering FX technology and serving clients in Latin America?

Being headquartered in Miami gives Edgewater a competitive edge by placing our global product, technology, and strategy teams at the gateway between North America and Latin America. We support institutions in Mexico, Chile, Brazil, Peru, and Argentina with access to market aggregation, advanced execution tools, and white-label trading infrastructure. Miami allows real-time collaboration, shared time zones, and faster alignment on market workflows than would be possible from traditional financial centers.

It is also one of the world’s strongest fintech ecosystems, where banks, hedge funds, and innovation-focused firms co-locate, creating ideal conditions for strategic partnerships and senior talent acquisition. For our Latin American clients, Miami translates to accelerated onboarding, enhanced post-trade support, and tailored workflow solutions rooted in firsthand market understanding. The region’s energy converges naturally in Miami—allowing us to scale our institutional product offering while staying tightly connected to the evolving needs and regulatory dynamics of emerging markets. Miami amplifies our mission: delivering precision trading technology globally while remaining deeply embedded in each local market we serve.

Paul Allmark, Chief Technology Officer

How have you reshaped Edgewater’s technology foundation over the past six months to prepare for the next phase of growth?

Over the past six months, my focus has been on strengthening the trading platform foundations that support Edgewater’s continued growth. That has meant kickstarting initiatives to improve scalability and transparency across our trading platforms, while ensuring our engineering organization is aligned to the needs of the business. We have been streamlining delivery processes and improving observability, allowing us to support increased client volumes and new products with confidence. A major priority has been laying the foundations to enable the business to move faster—providing the tools, architecture and trading execution frameworks that facilitate quicker delivery whilst maintaining enterprise-grade reliability. Overall, the last 6 months has seen most of my energy spent on ensuring our technology platform is fully prepared for the next phase of Edgewater’s expansion.

What strategic technology priorities will you focus on in 2026 to support Edgewater’s global expansion and evolving product mix?

In 2026 my primary objective will be supporting Edgewater’s ambitious growth agenda, particularly the expansion of our NDF franchise across Latam and Asia, and the scaling of our FCA-regulated business as it introduces other products. Core priorities will include sustaining consistently high execution quality and making incremental gains in price distribution performance. We will also be driving targeted system consolidation to simplify our architecture and unlock future innovation.

Continued investment in our differentiators—meticulous liquidity curation and an uncompromising approach to execution quality—will be high priorities as we improve on the resiliency and scalability requirements for a growing global client base. Ultimately, 2026 will be about enabling Edgewater’s next phase of expansion while delivering incremental improvements across core parts of the technology stack.

We have been working to ensure our technology platforms are fully prepared for the next phase of Edgewater’s expansion.

Alex, you and Skovran Schreder, the CEO of Edgewater Markets, have been on this journey together for over 15 years now, how have you persevered through various market turbulences and industry consolidation?

We have managed to stay focused throughout on identifying market opportunities, gaps in product offerings and especially listening to what our clients’ needs are.

Pictured left Alessandro Scarsini. Right Skovran Schreder

We have stayed clear of the shiny new object of the moment and focused instead on ensuring continued growth by providing the best possible platform in the market.

We strive to be the “mission critical” technology solution of choice. Industry consolidation is inevitable especially when much larger, well capitalized, and longstanding peers in the space realize their continued growth is dependent on providing their clients up to date product development through best of breed tech solutions.

Often to fill that gap they rely on very targeted acquisitions. This will continue no doubt. Edgewater, however, is very unique in the space as we provide our clients with technology, credit and execution services all in a one stop shop model.

In order to provide this all encompassing service we have developed very close partnerships with some of the largest financial institutions in the world and we will continue to forge new alliances as we scale and grow in the emerging market space.

Edgewater continues to expand its product suite and institutional offering, what is next in the Edgewater journey?

G10 FX is highly commoditized and generally a loss leader. There are a dozen ECNs out there, all competing with one another, whose focus is to match buyers and sellers for a nominal fee which is likely going to zero. We recognize at Edgewater that all our clients have G10 spot business to do, but our focus is to add value and be a relevant partner.

We were the first electronic platform in LATAM / Mexico with “boots on the ground”. We have 25 sales and support professionals in Mexico City, Santiago, and Sao Paulo (Argentina H1 ’26), that continue to manage our growth in tandem with our client’s needs. In just the past year for example, Argentina went from a country whose financial industry was basically unserviceable, to one that is now scrambling to onboard the right tech platform to access offshore markets.

We are the partner of choice for all the reasons I have mentioned. Edgewater will continue to expand in areas where we feel we can make a significant and immediate impact. This of course means targeting the EM world and there is no better time than now. Currently we have a very successful and leading metals product out of the UK, and this will lead into further expansion in the commodities space, likely with a presence in the Middle East (news to come soon…). Our aim is continuing to replicate our highly successful model in Latam across Asia and the Middle East. These regions not only necessitate the newest and best technology platform available, access to credit and markets, but a local partner that can help them better understand how to optimally utilize the tools they have just adopted.