THE END OF FRAGMENTATION

Cristian, financial services evolved for decades in vertical silos. Why is that model breaking down now, particularly in FX and trading?

If you look at FX brokers and trading institutions, fragmentation has always been a constraint. Trading systems, risk engines, client money, payments, and reporting were often handled by separate platforms that had to be stitched together.

What has changed is not just technology, but expectation. Today’s clients, whether retail or institutional, do not distinguish between funding, trading, transferring, or managing exposure. They expect a continuous, real-time experience delivered through a single interface.

In FX especially, where margin, liquidity, and exposure are constantly moving, siloed systems simply cannot keep up. The industry is moving from product-centric thinking to system-centric thinking, where trading, payments, and account structures operate as one.

What is important to add is that this convergence is felt most strongly at the front end. Clients do not see backend systems, but they immediately feel friction in onboarding, funding, or navigation. Fragmentation ultimately shows up as a broken journey, and that is where institutions are losing clients.

We have seen this model succeed at scale with platforms like Revolut and Robinhood. Why hasn’t it become the norm across brokers and banks?

This is because what people see is the interface, not the infrastructure underneath. Those platforms work because they were built on unified architectures from day one, but just as importantly, they were built with experience ownership in mind.

Most FX brokers and banks operate on layered legacy stacks that were never designed for this level of integration or real-time control. Typically, you will see a trading platform optimized for trading, a bridging engine optimized for execution, a separate wallet or payment system, another layer for onboarding and compliance, and reporting added on top.

Historically, trading platforms were also designed to be reused across many brokers with the same front end. That created scale for vendors, but it removed differentiation for brokers. If a client is unhappy, they can move to another broker using the same app, the same interface, and the same experience – just with a different logo.

That lack of differentiation creates very little stickiness, especially when client acquisition costs are high. Platforms like Robinhood or eToro succeeded not because of plumbing alone, but because the experience itself became the product.

WHY CONVERGENCE IS HARDER THAN IT LOOKS

What are the biggest structural barriers FX brokers and banks face when trying to modernize?

The biggest challenge is that most core trading and banking systems were built incrementally, not architected as ecosystems. In FX, brokers are being asked to add new asset classes, support more jurisdictions, offer instant funding and withdrawals, provide real-time risk and P&L visibility, and integrate with multiple liquidity sources. Banks supporting these flows face similar pressure, often acting as liquidity providers, custodians, or settlement partners, but on infrastructure that prioritizes stability over flexibility.

At the same time, many institutions are still locked into platforms where innovation at the front end is constrained by backend limitations. The plumbing works, but it does not allow you to rethink how clients are onboarded, engaged, or retained.

The result is a growing gap between what the market expects and what existing systems can realistically deliver without structural change.

Is this where institutions often go wrong in digital transformation?

Yes, and it usually comes from assuming there is a single transformation path for everyone.

Convergence is inevitable, but how you get there depends on whether you are a broker, a bank, or a hybrid institution. A broker focused on execution and client experience has very different priorities from a bank providing balance-sheet support or Banking-as-a-Service (BaaS).

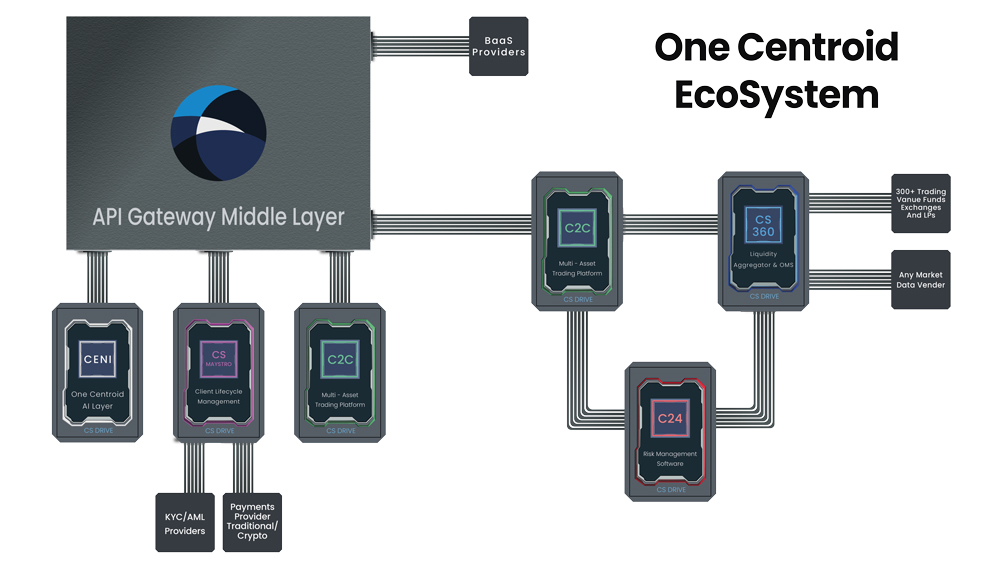

That is exactly why we designed the One Centroid Ecosystem around a single architecture that supports multiple operating models, while leaving experience design firmly in the hands of the client. No two institutions should be forced into the same front end or the same journey.

From Market Reality to Architecture

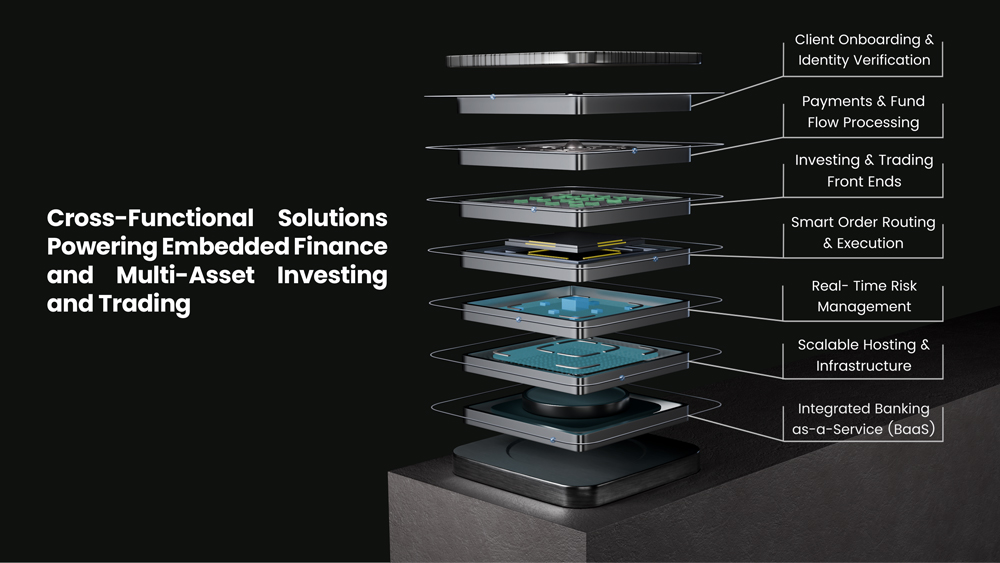

For FX brokers, convergence is not an abstract trend. Trading platforms increasingly sit at the center of broader financial journeys, intersecting with payments, wallets, custody, and regulated banking rails.

The challenge is not whether these components should connect, but how they can do so without compromising execution quality, risk control, or the ability to innovate at the product layer.

At the same time, banks supporting FX flow as liquidity providers, custodians, prime brokers, or BaaS partners face a related challenge: how to enable innovation around trading-led ecosystems while preserving stability at the core.

At Centroid, this led to a foundational design principle behind the One Centroid Ecosystem: one architecture, multiple operating models, and full freedom at the front end.

BANKS AS FINTECH ENABLERS: PARALLEL INFRASTRUCTURE BY DESIGN

How does this architecture work in practice for banks that support brokers and fintechs?

For banks, the strategic question is rarely how to rebuild their entire digital stack. It is how to enable innovation without destabilizing the core.

Many banks are moving toward a fintech-enablement model, providing regulated banking, custody, and settlement rails to fintechs, brokers, and consumer platforms through Banking-as-a-Service (BaaS). In that context, system replacement is neither practical nor necessary.

When a bank acts as a fintech enabler, the objective is isolation and control. You want innovation at the edge without contaminating the core, while still allowing fintechs to build differentiated client journeys.

How does this ‘parallel model’ look like inside the One Centroid Ecosystem?

Under the One Centroid Ecosystem, banks deploy a parallel, modern infrastructure layer specifically for fintech programs.

A new core banking instance, dedicated to fintech activity, runs alongside the bank’s existing core. It communicates with legacy systems where required, consumes and distributes services via true BaaS, and operates independently from retail and corporate banking.

This ensures fintech growth does not introduce operational or regulatory risk into core banking operations, while still allowing fintechs and brokers to innovate freely at the application layer.

Where does client onboarding and compliance sit within this model?

At the center sits CS Maystro, our multi-tenant Client Lifecycle Management platform. CS Maystro handles digital onboarding, KYC/AML, and compliance workflows, integrates payment providers and multi-currency wallet services, and supports unlimited fintechs in isolated tenants.

What is critical is that each fintech or broker can define its own onboarding logic and customer journey, while the bank retains centralized oversight and reporting. Compliance becomes a shared framework, not a constraint on experience.

How are trading, execution, and risk handled?

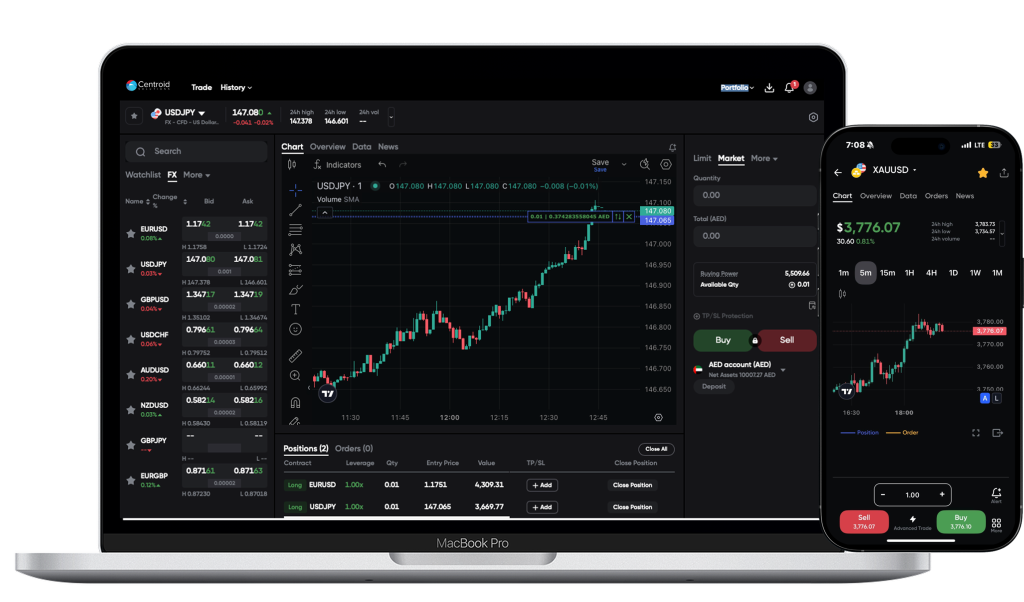

Each fintech or broker receives a dedicated instance of Centroid’s C2C trading platform backend, giving them full control over products, asset classes, and fee structures.

Execution and risk are centralized through CS 360, our unified OMS and liquidity engine. This allows institutions to scale fintech activity while preserving revenue capture, compliance, and control – without forcing everyone into the same front end or user experience.

BROKERS, SUPER-APPS, AND DIGITAL-FIRST PLAYERS: THE ECOSYSTEM IS THE PLATFORM

How does this differ for FX brokers, neo-brokers, and super-apps running their own client experience?

The reality is very different. Brokers and digital-first platforms are directly responsible for the end-to-end client experience. For them, convergence cannot be bolted on. Running fragmented systems with a generic front end creates churn. Clients compare experiences, not just spreads or product lists. That is why these institutions need unified onboarding, funding, trading, and account structures, seamless fund mobility, consistent compliance, real-time visibility, and a single data layer.

Just as importantly, they need the ability to build their own front ends, publish apps under their own brand, and continuously evolve the experience. Building front ends today is not prohibitively expensive. What matters is having an API stack that does not limit creativity.

Centroid’s C2C platform was built with this in mind, offering a comprehensive API layer for clients who want to build from scratch, as well as white-labeled front ends for those who want speed to market.

EXPERIENCE AS THE SOURCE OF STICKINESS

Where is real competitive differentiation shifting in today’s trading and fintech platforms?

What we see across the industry is that backend plumbing, while essential, is no longer where value is created. It has become a commodity.

The real differentiation – and the real stickiness – comes from how institutions design their client journeys, how they keep users inside their app, and how they turn infrastructure into engagement.

Brokers invest heavily in client acquisition. If the experience is generic, those clients are lost quickly to competitors using the same platforms. If the experience is differentiated, intuitive, and continuously evolving, the app becomes the client’s financial home.

That is the transformation Centroid is enabling.