Over the past 25 years, the FX market has experienced a profound technological transformation. While the spot market has led the charge in innovation, progress in the swaps, NDF, and options markets has been markedly slower. This is not to suggest that participants in these derivatives markets are still “shouting” as so vividly captured in Kevin Rodgers’ book. Instead, the most significant advancements have occurred in areas such as price creation and curve construction. On the distribution front, developments have largely been confined to multi-dealer Request for Quote (RFQ) platforms and attempts at establishing Central Limit Order Books (CLOBs). While these innovations have improved price visibility, they come with trade-offs – namely, the increased risk of market impact.

Efforts to enhance the efficiency of clearing large clips of FX derivative risk with minimal market impact have been limited. Most risk is still managed either through inter-dealer brokers (IDBs) or via a labour-intensive sales-and-trader coordination process centred on distributing “axes.” In practice, the only reason market participants are no longer “shouting” is that they are now “typing”—frantically navigating thousands of instant messages and emails in an attempt to capture the attention of a potential offset. Meanwhile, their counterparts are often overwhelmed, struggling to identify meaningful opportunities amidst an overwhelming sea of electronic noise.

The Winner’s curse

While multi-dealer RFQs simplify the process of gathering prices for a specific trade in one place, they do so at the cost of information leakage. By revealing intentions to a broad range of participants, traders risk exposing their hand without any assurance that the liquidity provider (LP) with the natural risk offset is included. Efforts to optimise LP selection have made progress, but these advances are far less developed for FX derivatives than for spot markets. They are constrained by factors such as credit ratings and product capability limitations, rely on historical data rather than real-time insights, and fail to pinpoint the LPs holding the liquidity in real-time.

This leaves buy-side traders facing a difficult choice: casting a wide net to involve more participants but risking market disruption or narrowing the pool and relying on luck for a favourable outcome. The sell-side fares no better. Multi-dealer RFQs often lead to a “winner’s curse,” where the successful LP assumes the risk but finds the market aware of their position.

Unless the LP is naturally “axed,” any attempt to manage that risk exposes them to greater market impact. The problem is compounded as contract liquidity diminishes, meaning significant time and effort is spent “pricing to miss” in markets such as FX options, swaps, and NDFs.

Multi-dealer RFQs effectively address the question of how to see more prices efficiently and are a valuable tool for small notional trades. However, when the objective shifts to identifying deeper liquidity pools, RFQs fall short. They fail to address the more fundamental issue: why is there a need for so many prices in the first place?

The only reason market participants are no longer “shouting” is that they are now “typing” —

frantically navigating thousands of instant messages and emails in an attempt to capture the attention of a potential offset.

Fully lit

When the FX market embraced electronic trading in earnest, it began with spot transactions, leveraging two primary CLOBs: Reuters and EBS. This market was well-suited to an exchange-like, price-and-time-based matching model, where the credit component (settlement) could be effectively managed to ensure pre-trade anonymity. For spot, and to some extent for pillar dates in swaps and NDFs, this model remains valid. However, as the broader market has grown more sophisticated, the “signalling” impact of any transaction on a fully lit market has significantly increased. This is especially true in an environment influenced by cross-asset correlation-driven algorithmic participants, resulting in greater liquidity venue fragmentation, smaller top-of-book sizes, and reduced market depth.

The challenges are compounded when firm prices must be displayed for derivatives. These instruments involve more complex credit dynamics and rely on multiple interlinked underlying components, making price calculation and accuracy increasingly intricate. While it may be easier to see a price and reference where a contract last traded, the likelihood of that price being incorrect or stale rises exponentially. As a result, market makers have little incentive to show meaningful liquidity, and even when they do, the fully lit nature of the CLOB creates potential conflicts with fair and orderly market requirements.

Lessons learned elsewhere

The evolution of electronic trading in the spot market offers valuable lessons for OTC derivatives – ironically, lessons that other asset classes, which adopted electronification later, have implemented more swiftly. The transition from voice broking to primary electronic venues brought significant transparency to top-of-book pricing but did little to facilitate the efficient clearing of large risk positions with minimal market impact. It also failed to adequately address the issue of “bad actors.”

The initial wave of algorithmic trading products, launched around 2005–2006, faced similar challenges. Their dealing patterns quickly became identifiable on primary venues, leaving a visible footprint. However, the market adapted over time. Today, curated dark pools and internal liquidity sources have become the preferred execution venues for managing risk.

The most effective algorithms now focus on optimising order placement across these venues to minimise market impact. Orders are executed first in the darkest pools, moving to progressively more transparent venues only when necessary—and even then, only when a time-sensitive urgency dictates. For end-users on both sides of the trade, the priority is the quality of liquidity at each price point and ensuring that their market footprint remains as small as possible.

Dealers understand that best execution requires a broader definition than just best price, especially in FX options where market impact is quickly identifiable. Hearing your client say their interest is ‘in the brokers’, especially for a large or sensitive trade, is a portent of the dreaded ‘line-out’ call that salespeople fear.

Two-Tier equity market:

Equities, arguably the home of the CLOB, are evolving to accommodate different forms of execution that more appropriately suit the client. The market is increasingly evolving into a two-tier structure: retail volumes trade on CLOBs, while institutional volumes are executed off-book via on-exchange venues.

This shift is evidenced by the ongoing decline in trading volumes on fully lit venues and the corresponding growth of bilateral trading. Similar lessons have been applied in fixed income and credit markets, where electronification initially lagged FX but has since matured into successful “axe-driven” or “dark-ish” venues. These platforms allow the sell-side to showcase interests to clients selectively, without exposing them to the broader market.

The buy-side benefits from aggregated liquidity in one place, enabling efficient execution with minimal market impact. Tradeweb and MarketAxess are prime examples of this evolution, where less liquid risks are now cleared more effectively, allowing banks to manage inventory dynamically.

Darkened pools and Best Execution

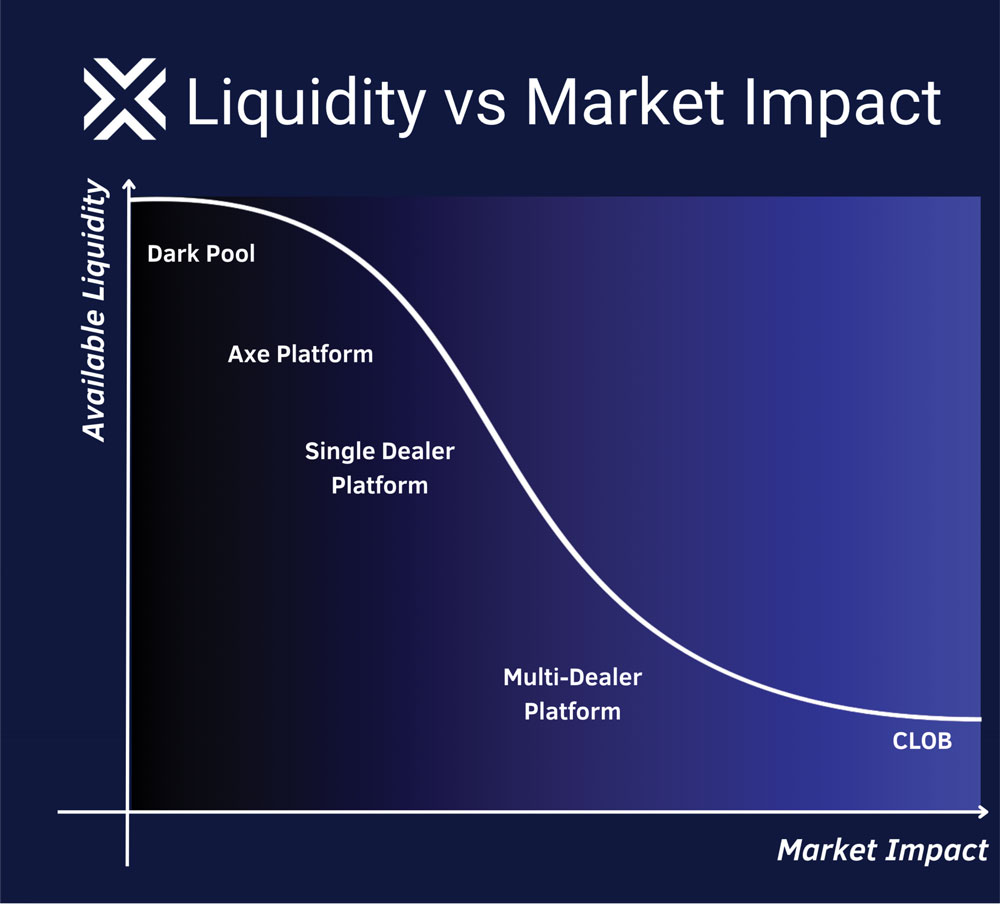

Efficient OTC markets have always been dark; significant tranches of risk can only be cleared that way. Electronification is not about making OTC fully lit. It’s about creating venues and workflows which allow participants to make informed decisions on where to execute with a clear understanding of the trade-off between available liquidity and market impact.

Sequencing from dark-to-lit allows for optimal execution outcomes. This is evident in other asset classes – volumes across fully lit equity platforms are down from 57% in 2020 to 46% in 2024- and ‘darker’ venues are increasingly popular in spot FX. But does that come at the expense of available liquidity? Well, in short that depends. Matching on an SDP will be dark but may not satisfy price discovery. Conversely a multi-bank RFQ will satisfy price discovery, but will compromise the execution via market impact. A CLOB seems to be sub-optimal for both considerations.

This is where ‘darker’ venues come into their own. Their growth across asset classes reflects the growing sophistication of participants to measure both Liquidity and Market Impact simultaneously. In OTC FX option execution, there was a gap. We listened to our clients and launched OptAxe to meet this need.

A targeted axe distribution platform which harnesses existing workflows and allows bilateral or multilateral liquidity to meet execution capability on a ‘darkened’ regulated trading facility. Private liquidity placement with counterparties you know are interested, data and market intelligence flowing back only to those who actively participate, reduced market footprint, and execution occurring between two bilateral parties who are genuinely axed.

Now that sounds like a liquidity solution which meets all the requirements of best execution.